tax minimisation strategies for high income earners

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. T he top income tax bracket c ould revert to 396 which was.

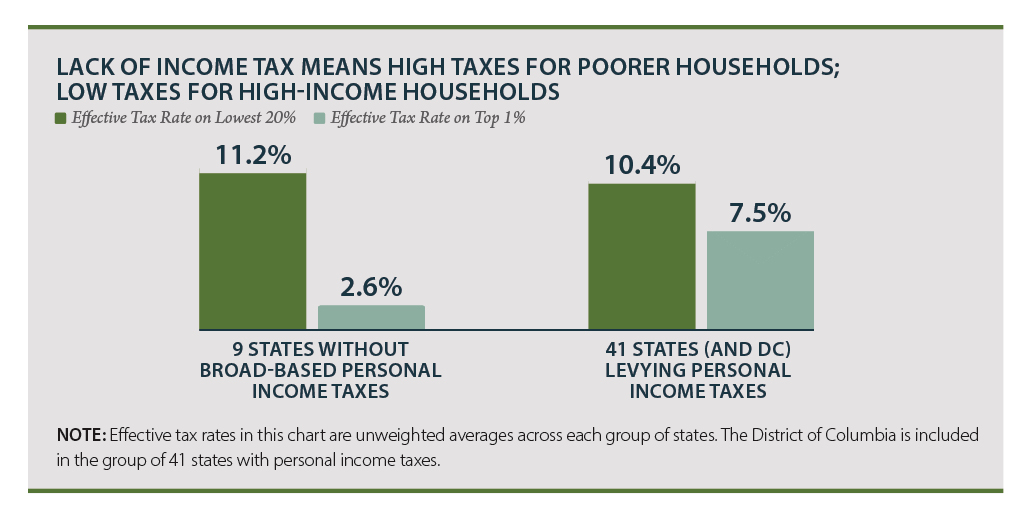

4 Ways To Reduce High State Income Taxes Arnold Mote Wealth Management

6 Tax Strategies for High Net Worth Individuals.

. As shown below deductions nearly. Because she stays at home she. A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT.

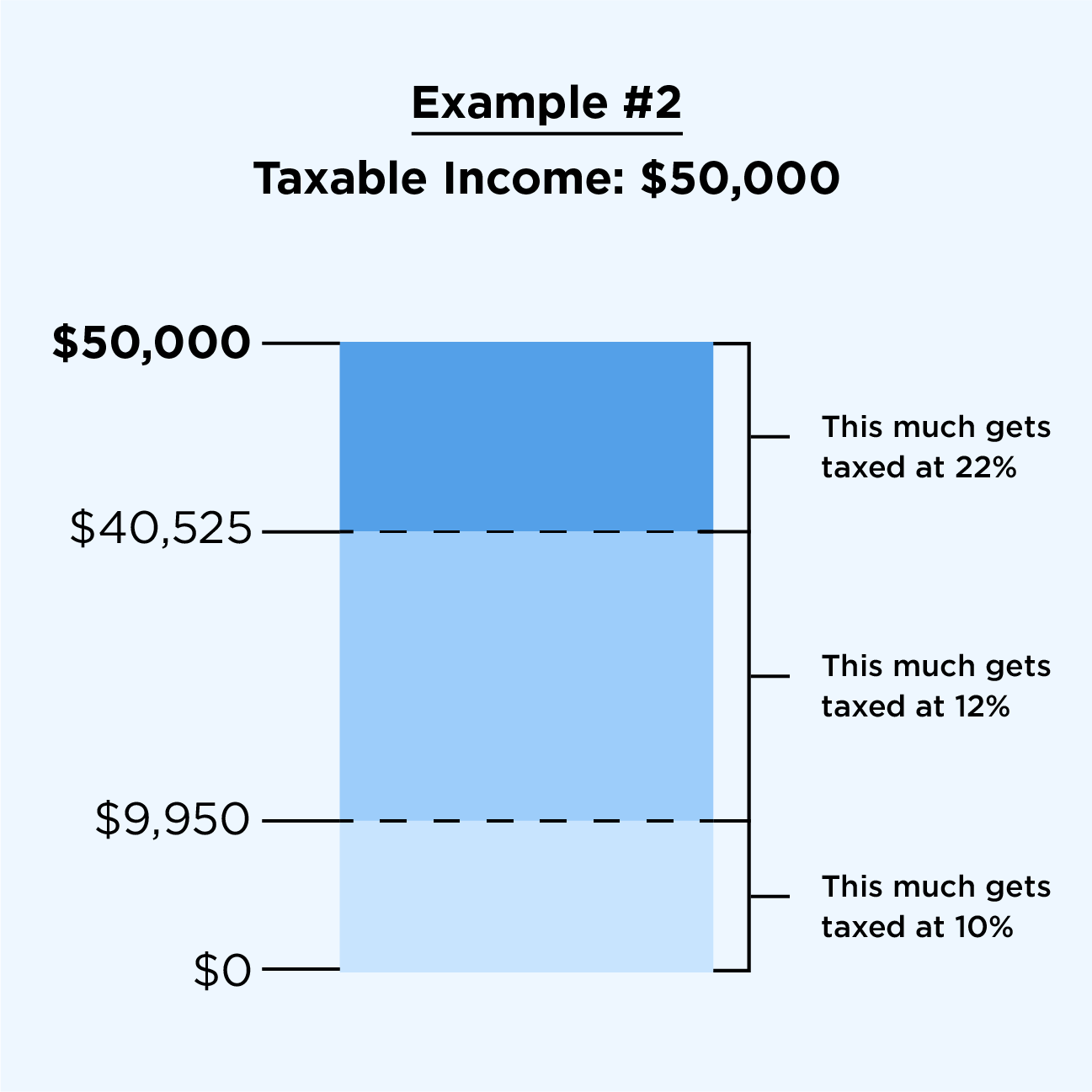

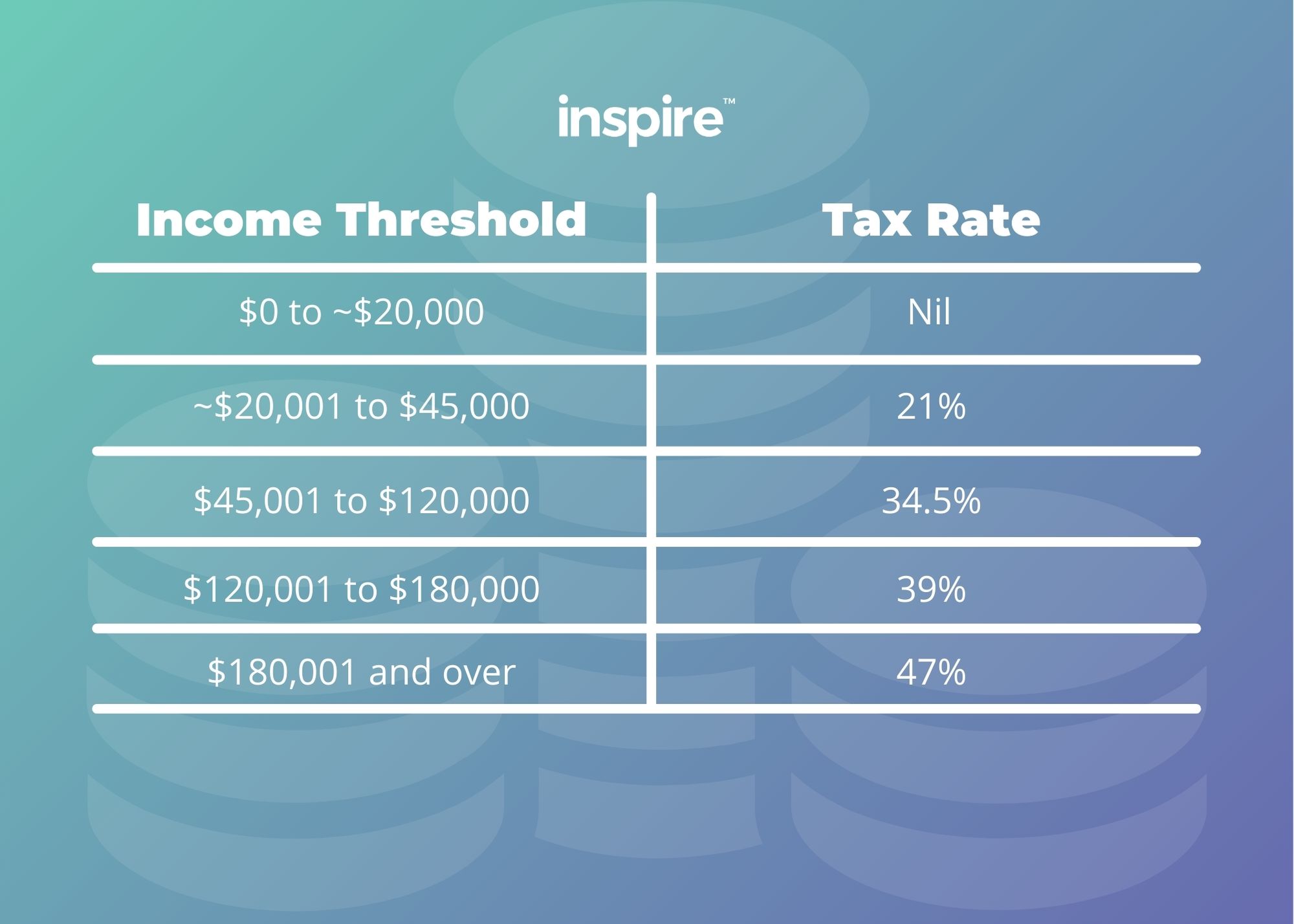

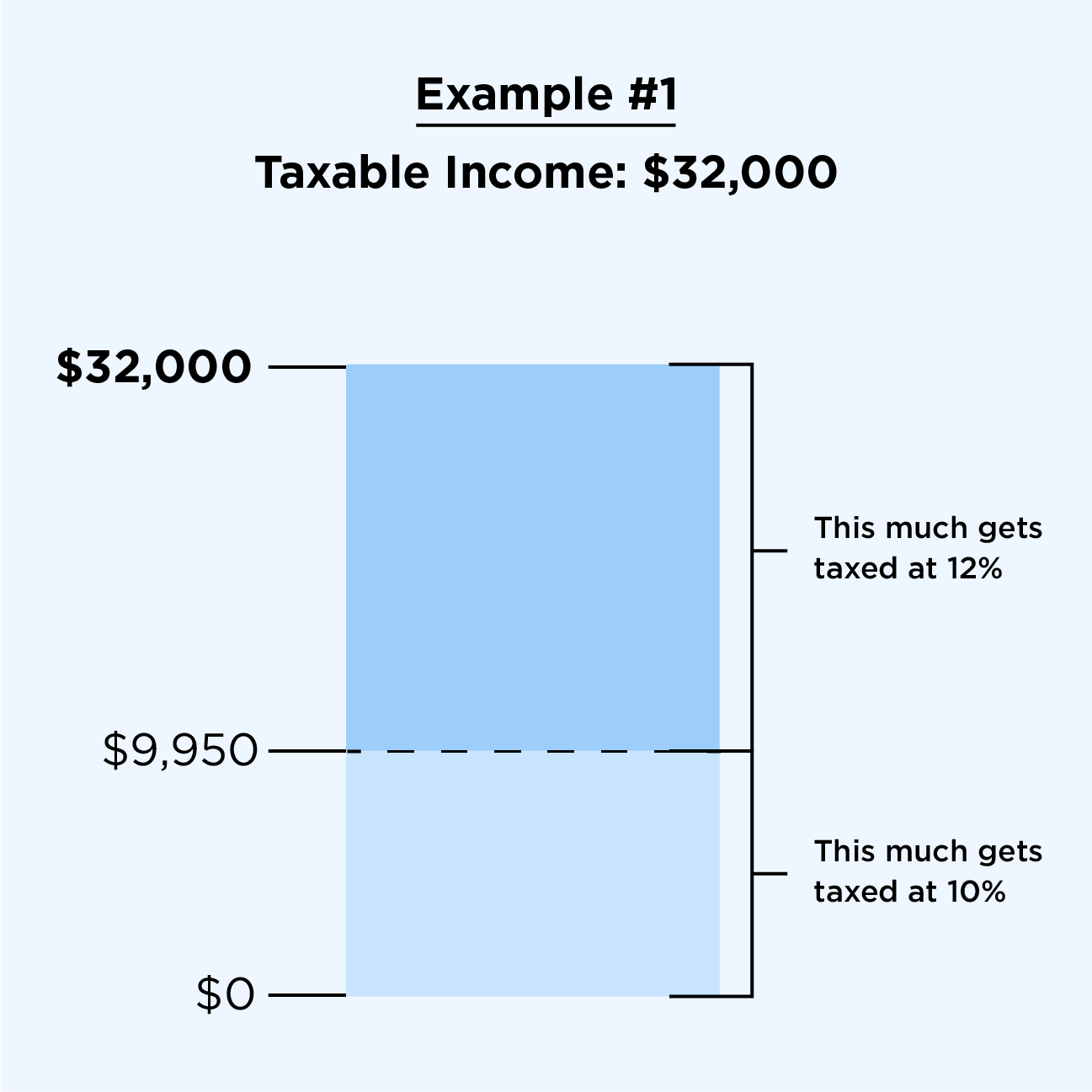

For several individual tax brackets the income tax rates were slightly reduced by new tax. Income in excess of 400000 may classify you as a high-income earner and subject you to higher tax rates. The biggest revision to the tax law in a generation was made by the Tax Cuts and Jobs Act of 2017.

Using this tax planning strategy a family can. Both are studying and will continue education for another 5. How to Reduce Taxable Income.

10 Things Everyone Should Know About Taxation Tax Strategies For Families With Children. Tax minimization strategies for individuals Income splitting with family members. This article highlights a non-exhaustive list of tax.

Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from. Reduce your tax burden and plan for future financial goals. Using a Discretionary Trust to reduce taxes.

The Tax Cuts and Jobs Act TCJA signed into law December 2017 and implemented in 2018 is currently set to sunset after 2025. Mon - Fri. If you are a high-income earner it is sensible to implement tax minimisation strategies.

Forward360 specialise in smart tax minimisation strategies for high income earners. So the money was distributed to Mary. Tax Planning Strategies for High-income Earners.

We will begin by looking at the tax laws applicable to high-income earners. 50 Best Ways to Reduce Taxes for High Income Earners. If you are an employee.

Invest-Borrow-Die is one of the tax planning strategies often used by families with millions or even billions of dollars. Jane earns 230000 salary per year and has 2 adult children of 19 and 18. An overview of the tax rules for high-income earners.

5 Outstanding Tax Strategies for High Income Earners. Because his income is so high any extra income will be taxed at the highest rate currently at 465. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000.

The recent tax law raised the standard deduction up to 24000 for couples. Effective tax planning with a qualified accountanttax specialist can help you to do that. High-income earners make 170050 per year.

Lets take a closer look at how to reduce taxable income using effective legal strategies. As a high net worth individual you should have no trouble surpassing. Max Out Your Retirement Account.

Invest in Tax-Free Saving Accounts TFSA Health Saving Accounts HSA Retirement Savings Accounts. Book a chat today. 1441 Broadway 3rd Floor New York NY 10018.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

How To Reduce Taxable Income For High Earners 20 Ways White Coat Investor

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Focused Investment Strategies For High Earners How To Keep More Of Your Savings For Retirement Retirement Matters

Advanced Tax Planning For Medical Professionals A Concise Guide To Tax Reduction Strategies Gallati Alexis E 9798613581160 Amazon Com Books

4 Important Tax Strategies For High Income Earners

Tax Saving Strategies For High Income Earners Smartasset

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth

Tax Deductions For High Income Earners To Claim 2022

The Top 9 Tax Planning Strategies For High Income Employees Inspire Accountants Small Business Accountants Brisbane

Tax Saving Strategies For High Earners Part I Stacking Bwm Financial

Retirement Tax Strategies For High Income Earners

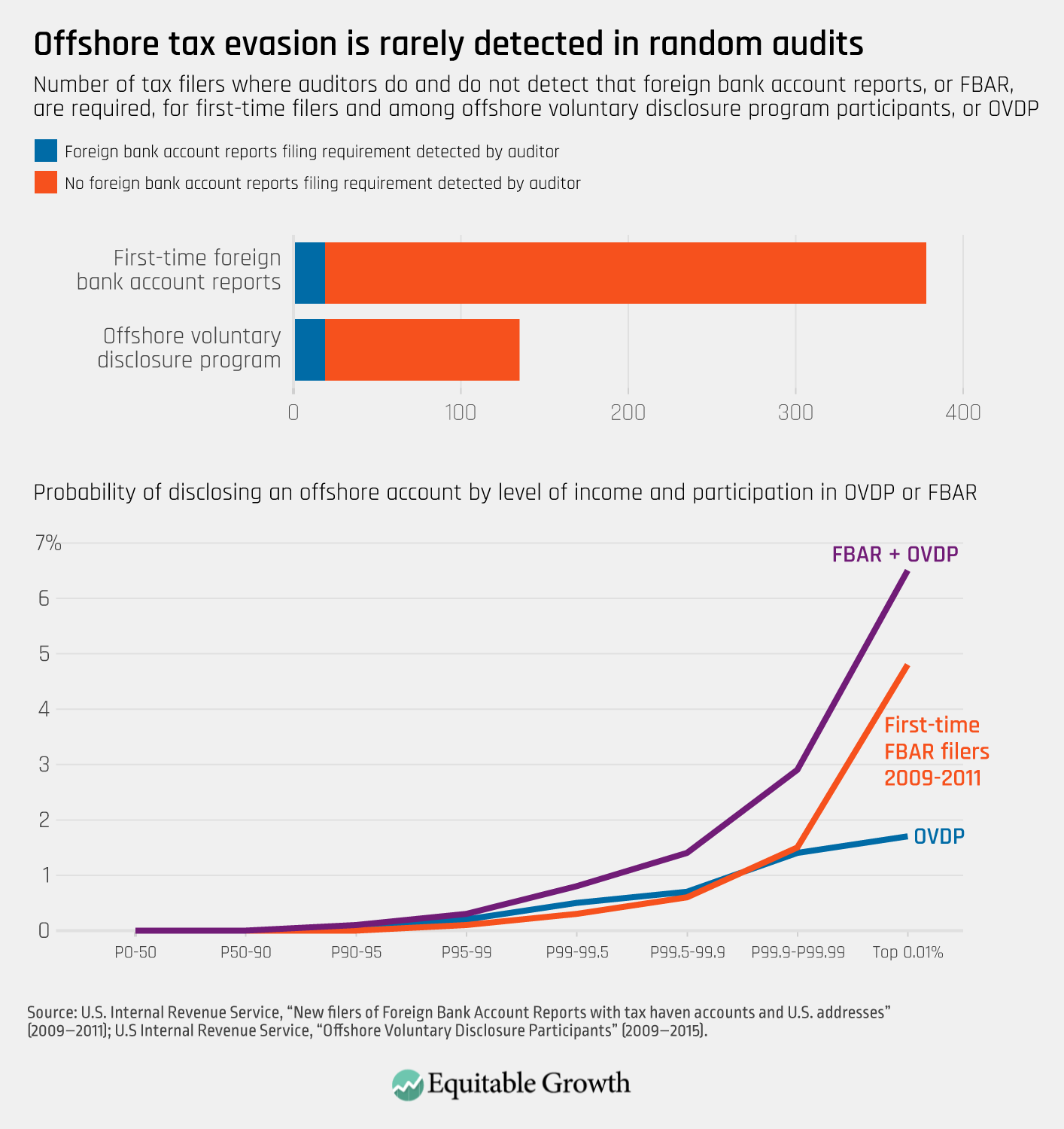

Tax Evasion At The Top Of The U S Income Distribution And How To Fight It Equitable Growth

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

5 Outstanding Tax Strategies For High Income Earners

Income Tax Reduction Strategies For High Income I Top Tax Savings Plans

The Health Savings Accounts Hsa Basics For High Income Earners