nassau county tax grievance workshop

Reduce your high property taxes with nassau county. North Hempstead NY Town of North Hempstead Supervisor Jennifer DeSena and Receiver of Taxes Charles Berman are pleased to announce that the Town will be.

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

If you are a homeowner who disagrees with the assessed value of your property I invite you to attend this Property Tax Assessment Workshop as the property tax grievance deadline of May 2 nd is approaching In January Nassau County notified residents of their homes tentative assessed value for the 2023-2024 school tax period and the.

. The information presented about how to file a challenge to your propertys assessment remains the same. While Nassau County determines your value we in Town government want to make sure you know that you have a right as homeowner to challenge your assessment. The assessment review commission is pleased to announce a series of community grievance workshops for the 19 nassau county legislative districts and local municipalities.

To noon and Tuesday Jan. We offer this site as a free self help. The Nassau County ARC will be granting a 60 day.

Nassau County Legislator Joshua Lafazan Woodbury is partnering with the Nassau County Assessment Review Commission to host a pair of online tax grievance workshops. You then have until April 15th to. Nassau County Tax Grievance Workshop.

Or you can call us at 516-342-4849. For further information you may contact the Nassau County Assessment Review Commission ARC at 516-571-3214. You can follow our step-by-step instruction to file your tax grievance with the Nassau County Department of Assessment to have your property taxes lowered for FREE or have one of our staff file you grievance for you.

During these webinars property owners who disagree with the assessed value of their property can learn how to navigate the grievance process utilize online research tools and dispute their assessment. This is the total of state and county sales tax rates. An Assessment Review.

Brian Devine 516 869-2475. The first step in the process is to file an affidavit with your county assessors office within six months after the assessment date on which the taxes are based or before June 30th if you have not yet received that notice. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

Ways to Apply for Tax Grievance in Nassau County. Nassau County Legislator Siela A. The New York state sales tax rate is currently 4.

Do not file an appeal online this year if you authorized an attorney or grievance service to file for you since September 1. Restaurants In Matthews Nc That Deliver. 2 2020 Taxable Status Date.

Free Tax Grievance Workshops Jan 25th 2022 12PM-2PM Jan 27th 2022 Thursday 12PM-2PM and Feb 17th 2022 Thursday 7PM-9PM. Submitting an online application is the easiest and fastest way. Click this link if you prefer to print out the application in PDF form and fax it to 631-782-3174.

Nassau County Legislator Siela Bynoe will be hosting a seminar about the process of challenging your Nassau County property tax assessment. A tax grievance can be filed by any property owner. If you have not already filed your tax grievance.

The Nassau County Department of Assessment offers a property tax appeal process. Town Partners with Nassau County to Host Virtual Assessment Review Commission Grievance Workshop. The following workshop took place in February 2020.

The workshop will be led by Nassau County Assessment expe. Opry Mills Breakfast Restaurants. Bynoe D-Westbury is partnering with the Nassau County Assessment Review Commission ARC to host free virtual community tax grievance workshops to inform residents about how to challenge their property taxes online.

Essex Ct Pizza Restaurants. Nassau County Legislator Kevan M. Nassau County Legislature District 1 - Kevan Abrahams Legislator Kevan Abrahams Presents Free Tax Grievance Workshops Jan 25th 2022 12PM-2PM Jan 27th 2022 Thursday 12PM.

North Hempstead NY Town of North Hempstead Supervisor Jennifer DeSena and Receiver of Taxes Charles Berman are pleased to announce that the Town will be partnering with the Nassau County Assessment Review. Nassau County Legislature District 1 - Kevan Abrahams. Legislator abrahams arc host virtual tax grievance workshop.

18 from 10 am. Workshops will be held Tuesday Jan. 25 from 7 to 9 pm.

Click Here to Apply for Nassau Tax Grievance. The workshop will be held on thursday march 28th at 7 pm. The Nassau County sales tax rate is 425.

Nassau and Suffolk Property Tax Reduction Specialist Call Us. Income Tax Rate Indonesia. Soldier For Life Fort Campbell.

If you pay taxes on a property in Nassau County you have the right to appeal your propertys annual assessment set by the Nassau County Department of Assessment on Jan. Abrahams D Freeport is partnering with the Nassau County Assessment Review Commission ARC to host a second free virtual community tax grievance workshop to inform residents about how to challenge their property taxes online. The Purpose of this Group is to provide information and links which will enable Nassau County Homeowners to file Tax Assessment Grievances on their own without having to pay any fees.

Roosevelt PAL Legislator Abrahams Launch Summer Double-Dutch Clinic at Rev. If you own a condominium unit do not file online until you check with your property management to determine if the board of managers is authorized to file on your behalf. This website will show you how to file a property tax grievance for you home for FREE.

Delivery Spanish Fork Restaurants. Nassau County legislators Dave Denenberg D-Merrick and Kevan Abrahams D-Freeport will present free tax assessment workshops on how to file a grievance of a property assessment with the county. Attend either of these FREE on-line workshops and learn how to file a property tax grievance yourself to reduce your assessed property value.

March 1 2022.

Legislator Debra Mule Invites Residents To Attend Upcoming Free Virtual Community Tax Grievance Workshops Longisland Com

Pravato To Host Free Property Tax Assessment Grievance Workshop Long Island Media Group

Nassau County Assessment Review Commission Facebook

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Pravato To Host Free Property Tax Assessment Grievance Workshop Town Of Oyster Bay

Kelly Forman Licensed Real Estate Advisor Compass Linkedin

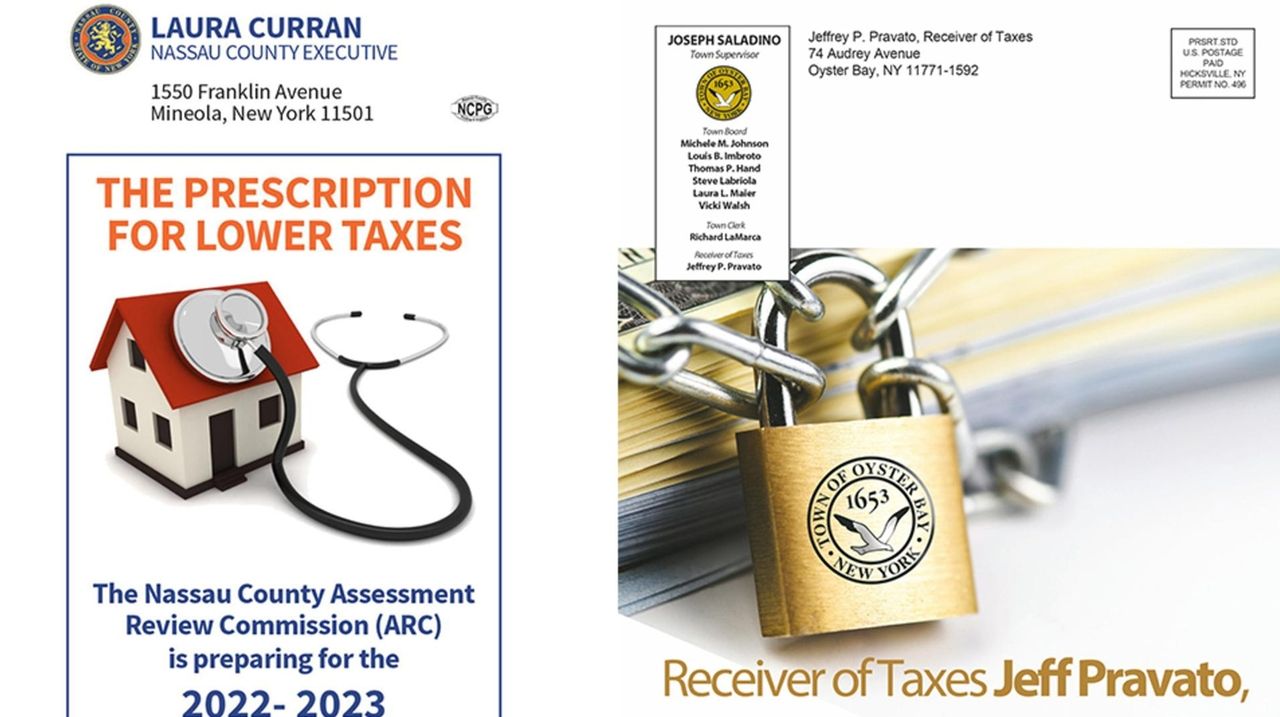

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

District 18 Updates Ld18updates Twitter

News Flash Nassau County Ny Civicengage

Nc Property Tax Grievance E File Tutorial Youtube

News Flash Nassau County Ny Civicengage

News Flash Nassau County Ny Civicengage

Legislator Siela A Bynoe Facebook

2020 Property Assessment Grievance Workshop Youtube

Property Tax Grievance Workshops Syosset Advance

Property Tax Grievance Workshops On March 24th And 25th Canceled Town Of Oyster Bay

Nassau County District 18 Updates Home Facebook

Legislator Debra Mule Facebook

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com